Let’s skip the small talk.

I’m back and I am pissed off. Read our headlines and then go down to the second section to see what I mean 😡

LINEUP

1. Headlines of the week 🗞️

2. Prediction Markets Are Gambling 🎰

3. Internal Booking 📲

4. Athlete’s Perspective Ft. Casey Toohill 🧠

5. Company of the Week: Joon.io 💼

NEWS

🚨Headlines of the Week🚨

Cricket star Virat Kohli has sold his brand, One8, to Agilitas. He joins the sportswear startup with an investment of $4.4M.

NBA Rookie of the Year Stephon Castle has invested in the Connecticut Sports Group, which is developing CT United FC.

Former NBA player Omri Casspi announced a new $100 million Opportunity Fund for his VC firm, Swish Ventures. The firm’s assets under management has been raised to $300 million.

LA Dodgers’ Mookie Betts has invested in baseball entertainment company, Home Run Dugout, joining as a brand ambassador and chair of its Athlete Advisory Board.

League One Volleyball (LOVB) announced LOVB San Francisco on Instagram. The ownership group includes three-time Olympic medalist Kelsey Robinson Cook and Bay FC co-founder/owner Leslie Osborne, alongside Ricky Lewis.

Denver Nuggets’ Spencer Jones has invested in Andiem. The company makes patented basketball shoes engineered to prevent ankle injuries.

A&A IN DEPTH

Kalshi Tries to Enter NIL

Kalshi has filed forms to accept bets on who enters the NCAA transfer portal.

This comes out of passion even more so than being informed… this is complete B.S. and would have negative implications for college sports, at a time when it already feels like things could not be more unregulated.

Athletes are already getting cash under the table to transfer; this would only accelerate that trend. And let’s be clear, Kalshi and Polymarket are gambling companies that come from Silicon Valley. As a guy who obsesses over innovation and new products, I will be the first one to call a spade a spade.

This not a new type of business. This is a gambling company. Synonymous with DraftKings, FanDuel, etc.

It’s only a matter time before FanDuel, Kalshi, Robinhood, Coinbase, DraftKings, are grouped into the same space of taking bets. The boundaries between the giants are blurring. Which is ok, but let’s stop wow-ing over what’s already been created.

I only speak for myself not on behalf of the rest of our team, but as a former athlete I despise sports gambling and relatively against it. Accepted bets over transferring would continue to tarnish the college landscape that seems to be slowly crumbling.

MOST VALUABLE PLATFORM

New Scheduling Interface!

Hey guys, we just published a new update where any athlete can book a meeting directly from the platform. Companies no longer need to provide booking links. Athletes no longer have to search for available times to drop in and book.

https://athletesandassets.com/investor/register

The next set of tools we are putting on platform are game-changing. Can’t wait for you all to meet your new team member 🙂

ATHLETE INSIGHT

Startup Investing by Casey Toohill

I get asked fairly often how I got started investing, what I look for, and how I think about startups in general. I wanted to share a few broad ideas around how athletes can interact with companies and where I think athletes actually have a unique advantage.

Most athletes know there are almost endless things you can invest in. When it comes to startups specifically, I usually think about it in three buckets: direct investments, fund investments, and equity partnerships.

All three have pros and cons, and like anything in this space, there is real risk involved. This is not advice, just how I’ve learned to frame it.

This also is not a comprehensive breakdown of every investment vehicle out there. There are other structures worth understanding, like SPVs, but for now I want to offer a more zoomed out view.

Direct investments, or angel investing, tend to get the most attention and hype. You can get early access to founders and companies, build a portfolio, and if things break right, the returns can be substantial. It is also the most challenging path. The risk is high, the learning curve is steep, and mistakes are common. That said, if you are genuinely interested in the space, it can force you to learn and grow quickly.

Fund investments are a different experience. Minimums can be high and access to founders is usually more limited, but you gain structure and diversification. If the goal is primarily financial exposure, strong funds often have a better return profile than trying to pick winners on your own. You also get the benefit of seeing how professional investors think about deals through updates and reporting.

Equity partnerships are where Athletes & Assets™ spends most of its time. These are not cash investments in the traditional sense. Instead, athletes earn equity by contributing value. That might be network, insight, credibility, marketing, or some combination of those. The financial downside is lower, but the expectation to contribute is real. Not every company is open to this model, but we are confident athletes bring far more to the table than just money or a social post.

There is no single right way to approach startups. Each path has tradeoffs, and what makes sense depends on your goals, time, and appetite for risk. The important part is being intentional about how you engage rather than defaulting into something simply because it sounds exciting.

As always, if anyone has thoughts or questions on the space, feel free to reach out.

COMPANY OF THE WEEK

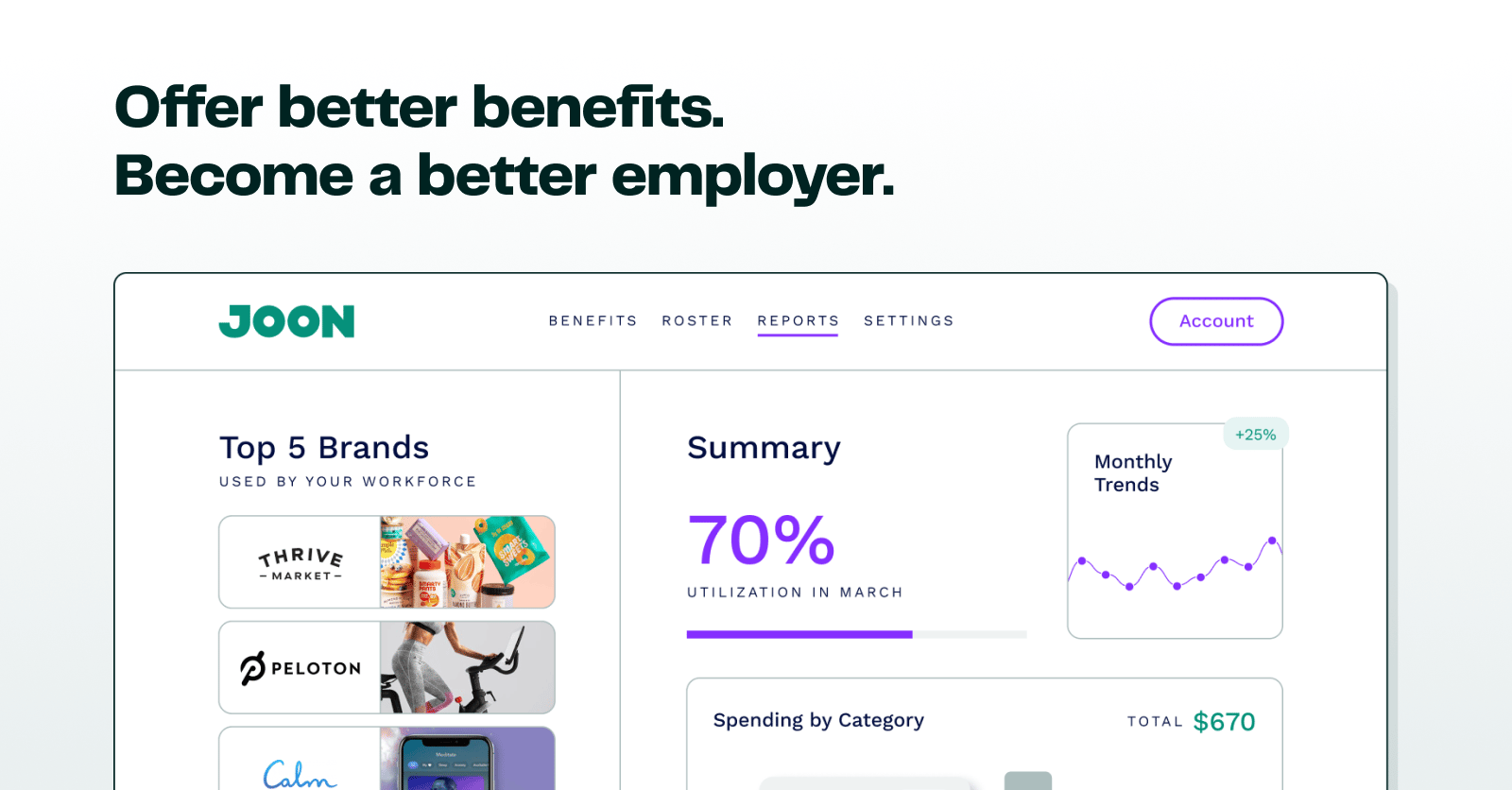

Joon.io

Joon.io is a Lifestyle Spending Account which allows employers to create a consolidated plan for employee benefits, customizing allowances and eligibility of individual merchants.

Instead of limiting health and wellness benefits to a specified list of gyms, any purchase from a merchant categorized as fitness could be eligible. This applies across health and wellness, remote work, education, and a wide variety of benefits vendors.

We’d love to work with companies like Joon, if you’re in the space please reach out!